America has suffered a lot during the pandemic, with a challenging loss of life, the government is determined to restart the US economy and plans to boot their GDP output by 5% over the coming years. The goal is to create an impact on productivity and bolster the labor force.

This all begins with what is the AJP or the American Jobs Plan, along with the AFP (American Families Plan). Getting this all back on track was the focus of the recent IMF review that oversees the annual economic policies of the United States.

Following an Executive Board discussion back in June, the IMF staff released a summarization of the plans to help boost the US economy to make up for losses in the early stages of the pandemic.

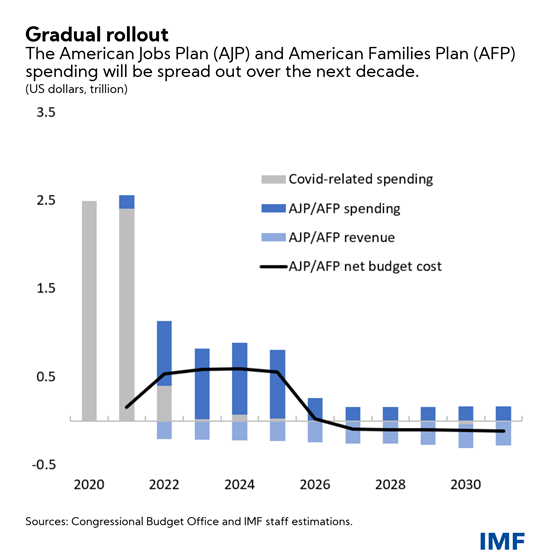

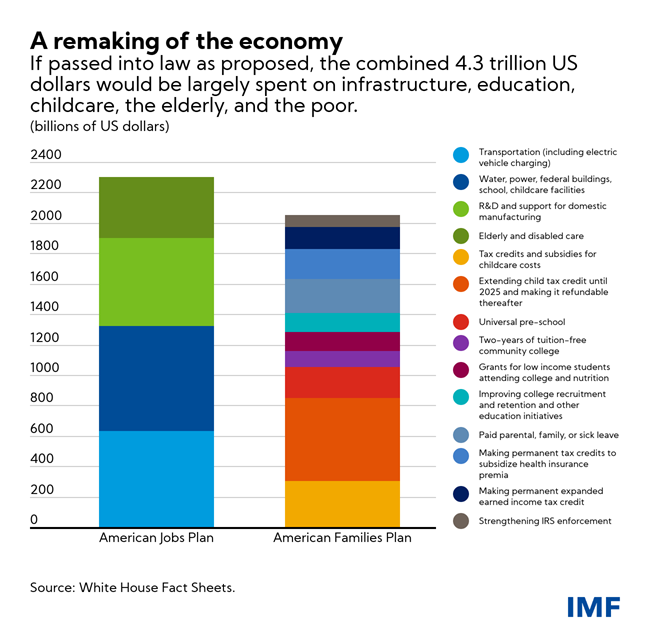

The AJP and the AFP promised to increase their spending along with their tax expenditures by a sum of 4.3 trillion US Dollars. This spending is to be done over the next decade. This plan is currently with the US Congress pending their approval. The reason for this is that the spending would, in part, be backed by raising taxes on corporate profits and those living in high-income households.

The Important Challenges with this Spending Plan

The plans put forward by the IMF come up against a number of challenges that have to be part of the reason why the US economy has taken a massive hit. For one, the pandemic is still in motion and as this continues, this impacts income inequality which leads to marginalized groups.

Because of this, there would have to be a substantial investment made by the AJP and the AFP. This would set out to support the human and physical capital that will alleviate the disparities and, in turn, create new opportunities greater than before when it comes to economic advancement.

The key areas for investment with such a plan would be in Development and Research, Childcare and Education. There would also be In-Home Care, which helps to increase support and production within the labor force.

This leads to the proposal of a refundable credit on child tax, leading to expanded earnings through income tax credit. By having the expanded healthcare coverage, it would help to significantly reduce poverty and will generate support for those in lower-income groups.

The Output of the Plan and its Impact

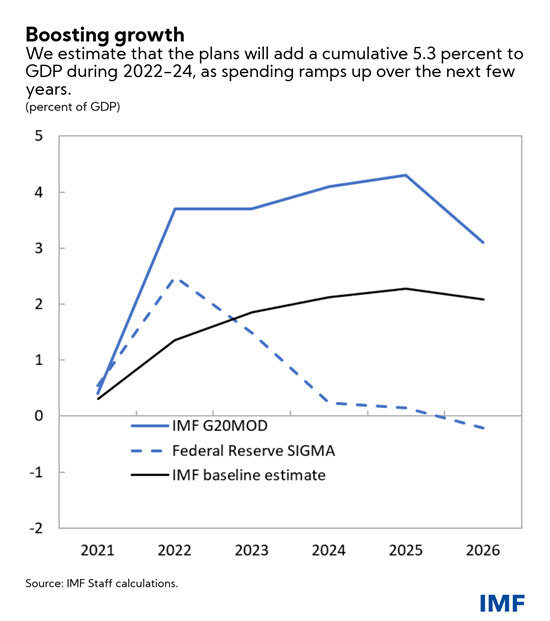

What has been estimated by the IMF is that a 5.3% spending by the AFP and AJP will boost US GDP through 2022 and into 2024. As this increase in spending occurs, the plan also takes into account the different fiscal multipliers involved, this means underlying variables can have an effect on the degrees of growth. One example of this is the child tax credit. This can boost the spending within the economy and provide the needed childcare support. But this also impacts on the parental labor force.

There would need to be spending done on the construction of the infrastructure that adds development and research, along with education which may help increase productivity in the long run.

IMF data on the plan also shows uncertainty on economic effects, when it comes to the size and timing of the plan. Produced estimates done by economic models which also included the IMF’s G20 MOD model and also the Federal Reserve’s SIGMA model.

The Implications of Debt Sustainability and Inflation

In recent months inflation has been at its highest levels, though expected to begin a decline towards the end of the year. From the beginning of 2022, the proposed plans will begin to moderate the pressures of inflation.

Fiscal packages will start to roll out over a 10-year period which will begin to boost the supply capacity within the US economy. This will help to alleviate the concerns that will come about regarding the underlying inflation. The forecast of which will be roughly 2.4% by the end of 2022.

The only concern with this is the public debt which will need to be lowered in the medium term of this plan.

The Recovery

The recovery of the US economy must be inclusive with Americans getting a share of the benefits of the IMF plan. When the rebound of the economy coincides with the receding pandemic, it is more important than it ever has been to support communities that have been marginalized, historically underserved, and impacted by poverty. The spending and changes with the tax will go a long way to help single-parent households, especially female-headed families that make up the larger percentage of the poor.

Investment into the areas of childcare, the low income labor force, universal pre-school, minorities and tax credits will boost productivity, and this creates higher wages within the labor force, leading to a more equitable economy.